The world of cryptocurrency is known for its volatility. Prices can surge dramatically one day and plummet just as quickly the next. While this inherent unpredictability can be daunting, particularly for newcomers, understanding the underlying patterns that often drive these price movements can provide valuable insights. These patterns are known as market cycles.

Like traditional financial markets, the cryptocurrency market tends to move in cyclical patterns, albeit often with greater speed and intensity. Recognizing these cycles can help investors and traders make more informed decisions, manage risk, and potentially capitalize on emerging opportunities. While predicting the exact timing and magnitude of these cycles is impossible, understanding their characteristics can be a powerful tool.

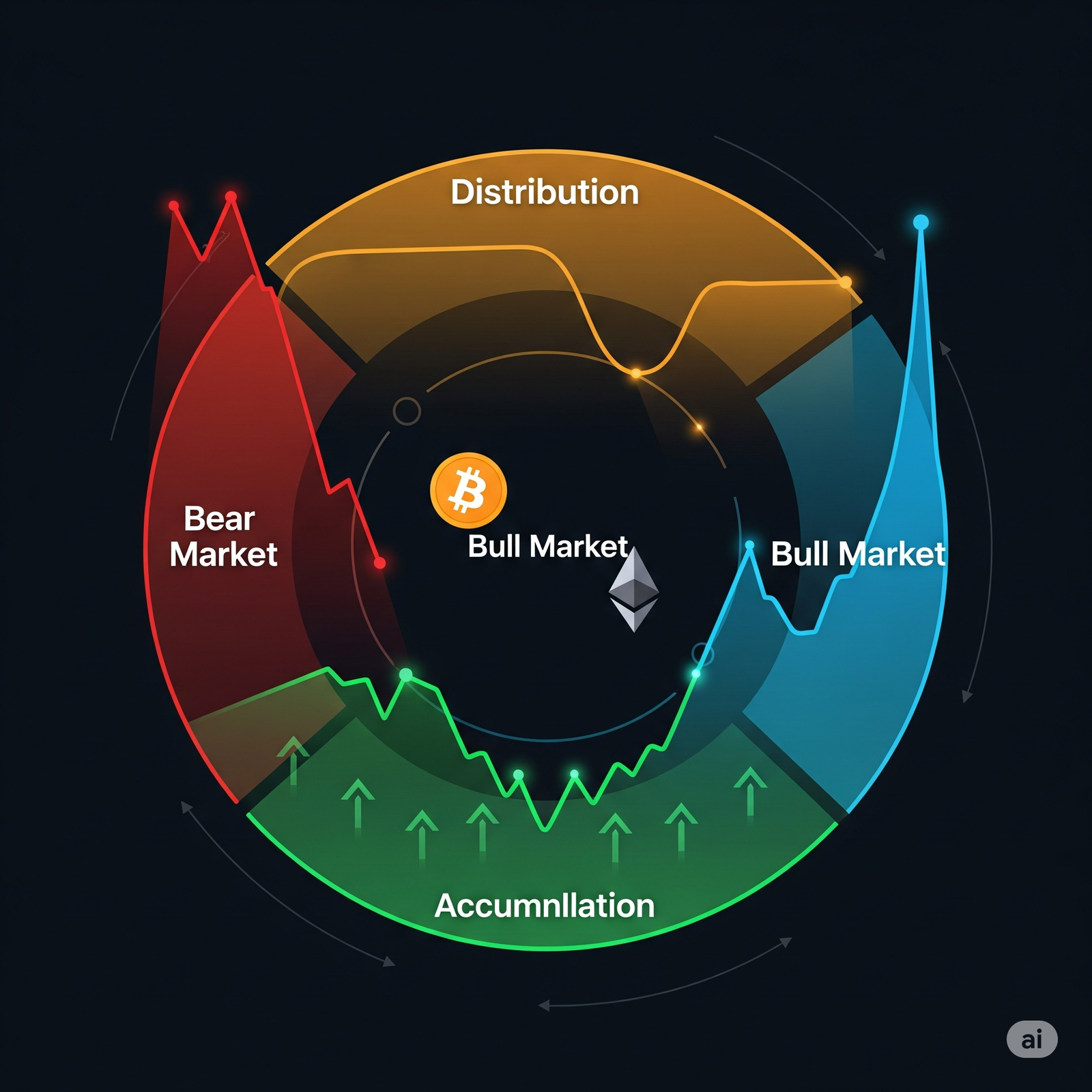

There are generally considered to be four main phases in a market cycle:

1. Accumulation Phase: This phase typically follows a significant market downturn. Investor sentiment is generally negative, and many have exited the market. However, this is when savvy investors, often referred to as “smart money,” begin to accumulate assets at relatively low prices. Trading activity is usually low, and price movements are often sideways or show gradual, hesitant upward momentum. This phase can last for an extended period, and it’s characterized by a lack of widespread interest or excitement.

2. Markup Phase: This is the phase where the market begins to gain upward momentum. As the accumulated assets start to be recognized for their potential or as new positive catalysts emerge, demand increases. Prices start to rise, often gradually at first and then with increasing speed and volume. More investors begin to enter the market, driven by the fear of missing out (FOMO). This phase can be characterized by increasing optimism, positive news flow, and significant price appreciation.

3. Distribution Phase: Following a substantial price increase, the market often reaches a point of exhaustion. Early investors and those who accumulated during the first phase may start to take profits. While prices may still be high and there might be periods of sideways trading or even further small increases, the underlying buying pressure begins to weaken. Sentiment can become euphoric, but smart money starts distributing their holdings to newer entrants. This phase is marked by increased volatility and uncertainty, often with mixed signals and a struggle to maintain the previous upward trajectory.

4. Markdown Phase: This phase marks the beginning of a significant price decline. As selling pressure intensifies and the realization sets in that the previous highs were unsustainable, prices start to fall sharply. Fear and panic selling can accelerate the downward momentum. Many investors who bought at the peak face significant losses, leading to further liquidations. This phase can be rapid and brutal, erasing a significant portion of the gains made in the markup phase. Eventually, the market reaches a low point where selling pressure subsides, and the accumulation phase may begin again.

Understanding the Importance:

Recognizing these market cycles, even in their broad strokes, can be beneficial for several reasons:

- Risk Management: Identifying the distribution and markdown phases can prompt investors to take profits or reduce their exposure to the market, helping to mitigate potential losses.

- Identifying Opportunities: The accumulation phase can present opportunities to acquire assets at potentially undervalued prices.

- Managing Expectations: Understanding that market downturns are a natural part of the cycle can help investors avoid emotional decision-making during periods of price decline.

Conclusion:

While the cryptocurrency market is still relatively young and can be influenced by unique factors, the concept of market cycles provides a valuable framework for understanding price movements. By learning to recognize the characteristics of each phase, investors and traders can navigate the volatile crypto landscape with greater awareness and potentially improve their long-term outcomes. Remember that this is a simplified overview, and real-world market cycles can be complex and influenced by numerous factors. Continuous learning and adaptation are crucial for success in the crypto market.

Leave a Reply